Ssdi taxable income calculator

MAGI is calculated as Adjusted Gross Income line 7 of IRS Form 1040 plus tax-exempt interest income line 2a of IRS Form 1040. Social Security operates two benefit programs for people with disabilities.

This Social Security Planner Page Explains When You May Have To Pay Income Taxes On Your Social Security Benefits Income Tax Income Social Security

Estimated household income at least 100 of the Federal poverty line.

. You may qualify for the PTC if your household income is less than 100 of the Federal poverty line and you meet all of the following requirements. Subsidy eligibility is based on income ACA-specific MAGITo qualify for a subsidy a household must have an income of at least 100 of the federal poverty level or above 138 of the federal poverty level in states that have expanded MedicaidAnd although there is normally an income cap of 400 of the poverty level. Hi Debbie thanks for using our blog.

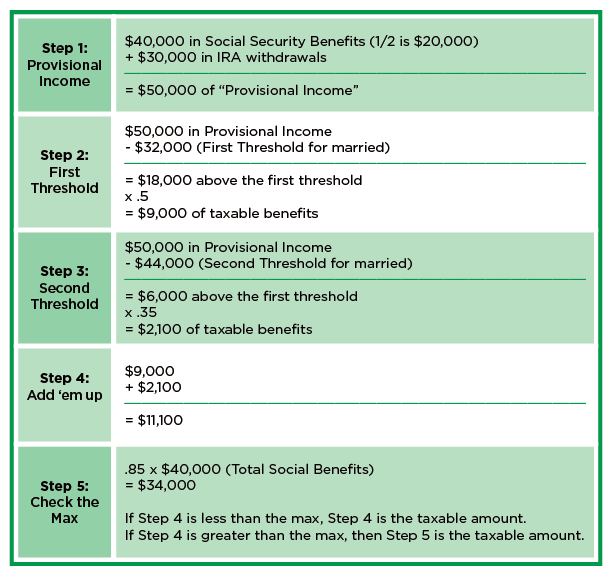

Lets say youre single and your income for the 2021 tax yearthe tax return you file in 2022includes 12000 in SSDI benefits and 20000 in other income. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. See details on retirement income in the instructions for IRS.

Number of people receiving Social Security Supplemental Security Income SSI or both July 2022 in thousandsType of beneficiary Total Social Security only SSI only Both Social Security and SSI. This makes SSDI benefits different from Supplemental Security Income SSI benefits which cannot be garnished. The type of disability benefit you get and your overall income.

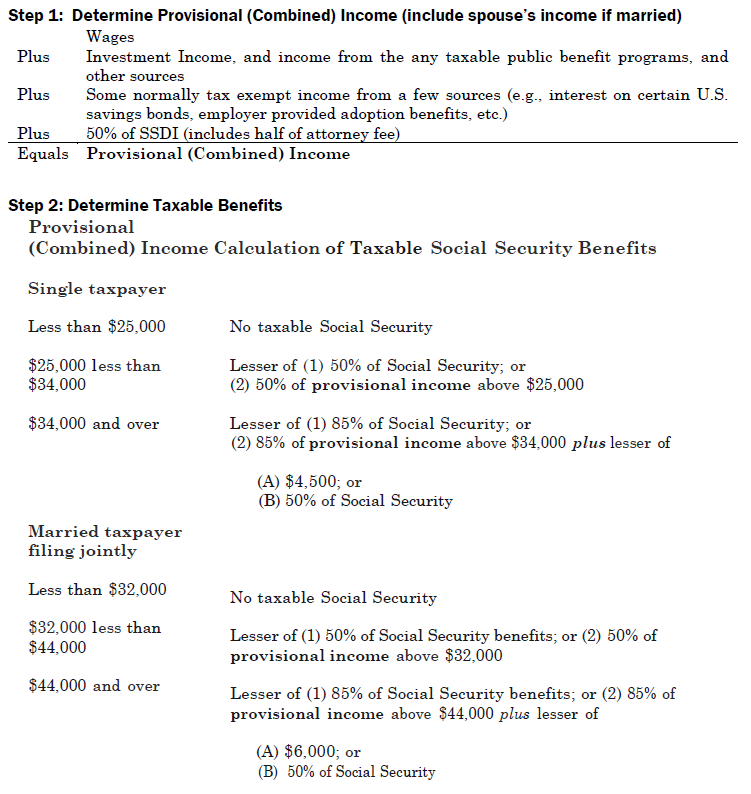

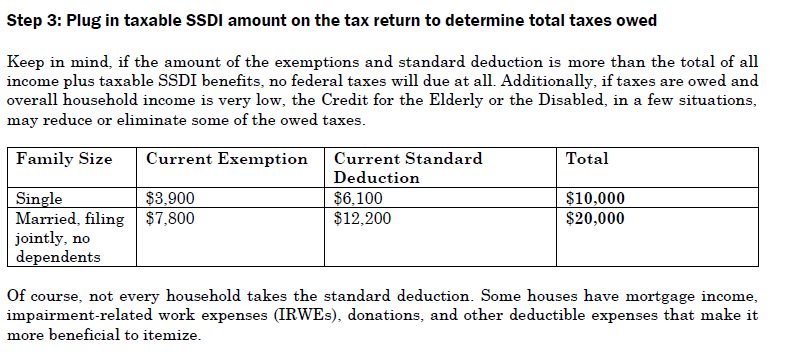

You can perform simple services like requesting a replacement Social Security card or more complex things like applying for Social Security Disability benefits. If your provisional income is more than 34000 on a single return or 44000 on a joint return up to 85 of your benefits may be taxable. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity.

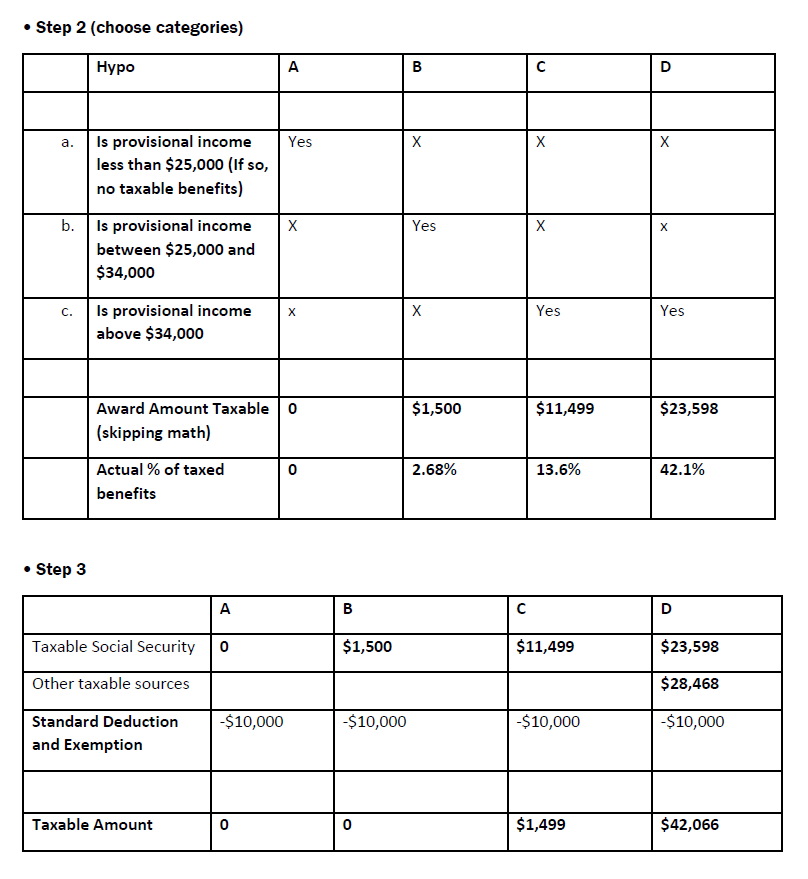

In addition to receiving social security payments he received a fully taxable pension of 18600 wages from a part-time job of 9400 and taxable interest income of 990 for a total of 28990. SSI is cash assistance for disabled blind and older people with low incomes and limited financial assets. These programs are for direct disability benefits SSDI and supplemental income benefits.

They might be depending on two things. But do not include Supplemental Security Income SSI. Amount of Monthly Income.

If youre comparing these two types of Social Security benefits then you should know that. How do you calculate modified adjusted gross income for Irmaa. You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

Social Security and Supplemental Security Income SSI benefits for approximately 70 million Americans will increase 59 percent in 2022. Insurance is a means of protection from financial loss. Federal law does allow SSDI to be garnished for unpaid child support arrearages.

Amount of Annual Income. Beginning with the month you reach full retirement age earnings no longer reduce your benefits no. The SSI benefits are paid out to low-income low-asset adults and disabled children.

Calculate college costs loan payments savings goals and EFC. In addition to the employees tax your employer is also required to pay 62 of your gross income into the system. Include both taxable and non-taxable Social Security income.

The services available at your local field office are fairly standard. Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. Note that this amount is entirely separate from the amount of income tax that you will owe to the IRS.

He received a Form SSA-1099 in January 2022 that shows his net social security benefits of 5980 in box 5. Once youve made it through the elimination period and start receiving long-term disability insurance benefits your income is protected and youll have money coming in so you can pay bills even when you cant work. Who is eligible for an ACA subsidy.

Social Security Disability Insurance SSDI and Supplemental Security Income SSI. If Brooke has an income from wages of 40000 an. Social Security Administration SSA Services In Minneapolis Minnesota.

Include most IRA and 401k withdrawals. The Social Security Administration says about 40 of. Social Security has an online calculator that you can use to.

An Example of Taxable SSDI Benefits. If you attain full retirement age in 2021 the earnings limit is 50520 but we only count earnings before the month you reach full retirement age. The amount youre allowed to earn while receiving benefits depends on your age.

Combining your other income with half your SSDI benefits gives you a taxable income of 26000. If youre single and you have more than 25000 in income per year including half of your SSDI benefits a portion of your SSDI benefits will be subject to tax. The table below details the base premium amount youll pay for Medicare in 2021 depending on your MAGI and filing status inclusive of any additional IRMAA.

The SSDI payments are for those who are disabled and need income assistance. Most long-term disability insurance policies pay out for two five or 10 years or until retirement. Enter the full amount before any deductions.

The 59 percent cost-of-living adjustment COLA will begin with benefits payable to more than 64 million. The average disability benefit for a recipient of SSDI in 2022 is 1358 per month but a beneficiary can receive up to 3345. Retirement or pension Income.

The standard OASDI tax rate for withholdings for employees is 62 So you will see 62 of each paycheck withheld for Social Security tax. So 40 credits are roughly equal to 10 years of work. Learn about saving for college 529 plans financial aid scholarships FAFSA and student loans.

You can make the calculations on the IRS Form 1040 tax return or you can use Social Securitys tax calculator. Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. Social Security Disability Income SSDI Yes.

More specifically in 2022 an individual receives one credit for each 1510 in income and they can earn a maximum of four credits per year. Standard Social Security retirement benefits and SSDI may be taxable up to a certain amount if your total income is more than 25000 or 32000 for spouses filing jointly. Kristynas adjusted taxable income is 45000 for child support purposes.

Resource Taxable Social Security Calculator

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

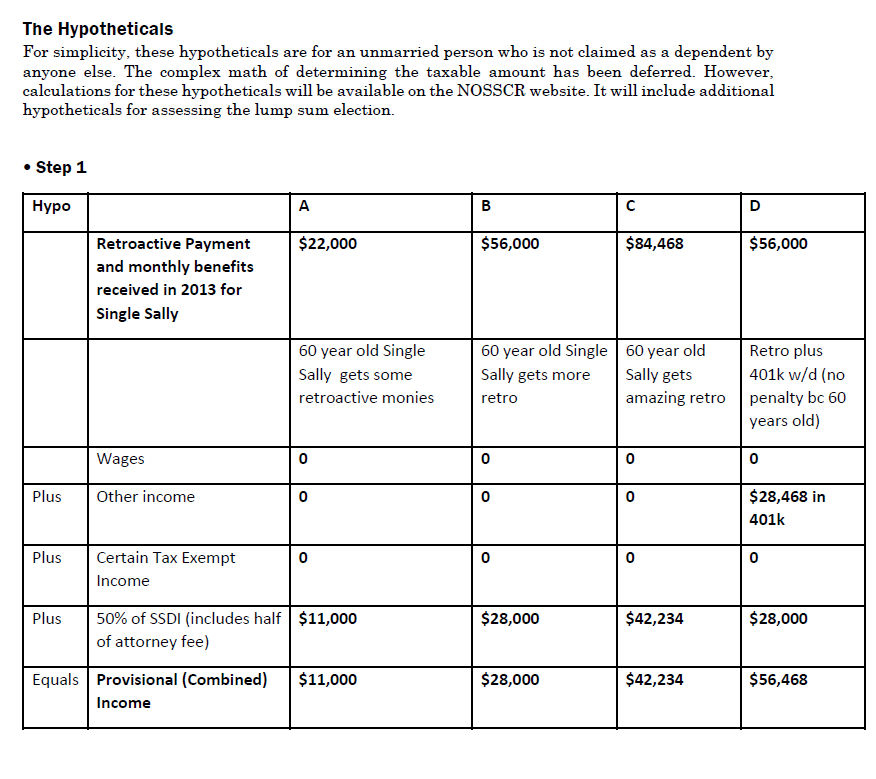

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

Tax Withholding For Pensions And Social Security Sensible Money

Taxable Social Security Calculator

Ssdi Benefit Calculation Ankin Law

Calculating Taxable Social Security Taxes On Social Security Benefits Part 2 Of 2 Youtube

Social Security Benefits Tax Calculator

Taxable Social Security Benefits Calculator Youtube

Ssdi Federal Income Tax Nosscr

Social Security Benefits Tax Calculator

Social Security Benefits Tax Calculator

How To Maximize Social Security Benefits On Your Tax Return Fox 59

Taxable Social Security Calculator

Social Security Benefits Tax Calculator

Ssdi Federal Income Tax Nosscr